Do Doctors Prefer HMO or PPO?

Is your practice being choked under a mountain of referral paperwork, or are you seeing the reimbursement rates that your expertise is actually worth?

The long-running controversy about payer models continues to take center stage in practice management in the complicated environment of US healthcare in 2026. We pose the question of who is paying and how much work it is going to take to get paid. Every time you open a new patient file, it affects your clinical flow.

To most practitioners, it is not just a question of money but rather a question of the quality of life when deciding between managed care and flexible networks. In this blog, we are going to dwell upon the delicate question: do doctors prefer HMO or PPO? Let’s begin

What is PPO in Healthcare?

A Preferred Provider Organization (PPO) is a health plan that is based on an agreement with medical providers to establish a network of health providers. In our case, the PO model works on a Fee-For-Service (FFS) basis. Patients are free to visit any doctor they wish, even out-of-network experts, without the referral of a primary care physician (PCP). This is typically a provider-side implication, i.e., more potential patients and less gatekeeper work.

What is an HMO in Healthcare?

The model Health Maintenance Organization (HMO) is constructed on the principle of the so-called managed care. It demands that patients remain a part of a particular network and choose a PCP who will serve as a gatekeeper. Experts are inaccessible in this system without a referral. In the case of doctors, HMOs may include some capitation, which is a certain amount of money the patient is required to pay in a month without regard to the number of visits to the doctor. Although this can offer a predictable source of income, it can also have much increased administrative control.

HMO PPO Differences: Impact on Care Access

The underlying disparity is the tension between the patient and the provider.

- HMOs focus on containment of costs, which may tend to create delays in prior authorization that complicate access to care immediately.

- PPOs are a more direct route to special care.

Since PPOs give patients the option of going out-of-network (although at a higher cost to them), we tend to see that, in this case, the decision regarding clinical matters ends up being made between the doctor and the patient, not between the doctor and the insurance adjuster.

Why Some Doctors Prefer PPOs (Preferred Provider Organizations)

Ask a room full of experts what kind of health insurance doctors like; most people will probably refer to PPOs. This preference has three major pillars discussed below:

1. Higher Reimbursement Rates

There is no hidden secret that PPO contracts typically have more allowable amounts in terms of procedures and consultations than HMO schedules. In a 2024 AMA study, it was observed that reimbursements of PPO are 15 to 25 percent higher than HMO reimbursements for the same CPT codes. In the case of a high-overhead practice, this margin is the difference between success and survival.

2. Autonomy and Reduced “Gatekeeping”

With a PPO, you do not need to wait when a patient needs to be treated due to a referral from the PCP. This accelerates the time to treatment, which is crucial clinically in such areas as oncology or cardiology. We discover that PPOs enable you to utilize your license to the highest level without being interrogated by a middle-level auditor at any insurance company.

3. Reduced Administrative Cost

The PPO model will have fewer forms to fill in, as it is not interested in every move of the patient in the process of management. Why do doctors prefer PPO? As they are aspiring to be doctors, not data-entry clerks. The minimized referral management will enable employees to attend to patient experience instead of running after codes in other offices.

Why Some Doctors Prefer HMOs (Health Maintenance Organizations)

Although PPOs have gained popularity, the HMO model does not lack its supporters, especially among Primary Care Physicians and large multi-specialty groups.

- Predictable Cash Flow: Capitation models offer a predictable monthly payment. This may be some kind of buffer in low months (end of summer or holidays).

- Patient Loyalty: HMO patients are very loyal, as they can only visit a network. They are much less likely to be doctor hoppers, and it is possible to manage long-term chronic diseases better.

- Integrated Care Models: Large systems are able to prosper on the HMO model due to the possibility of complete integration of the pharmacy, lab, and clinical services.

The Trade-offs for Doctors

There is a direct trade-off between the volume and value in choosing these models.

- HMOs offer the volume (a constant flow of referred patients) but at a decreased per-click value.

- PPOs offer the value (greater charges) but expect the practice to advertise itself to draw these patients to the practice in a competitive environment.

Call to Action: Is your practice balance skewed too heavily toward low-reimbursement plans? Call Capline now to conduct a full payer mix analysis.

Factors Influencing Doctor Preference

A number of external variables determine the inclination of a practice to either of the two models:

- Geography: In the countryside, there may be one HMO controlling the market, and to survive, one has to join it.

- Specialty: PPOs are favored almost universally by surgeons because the procedures are expensive, and direct access is required.

- Practice Size: Small, independent practices have been facing the challenge of the referral management overhead of HMOs, which is why PPOs may be more appealing.

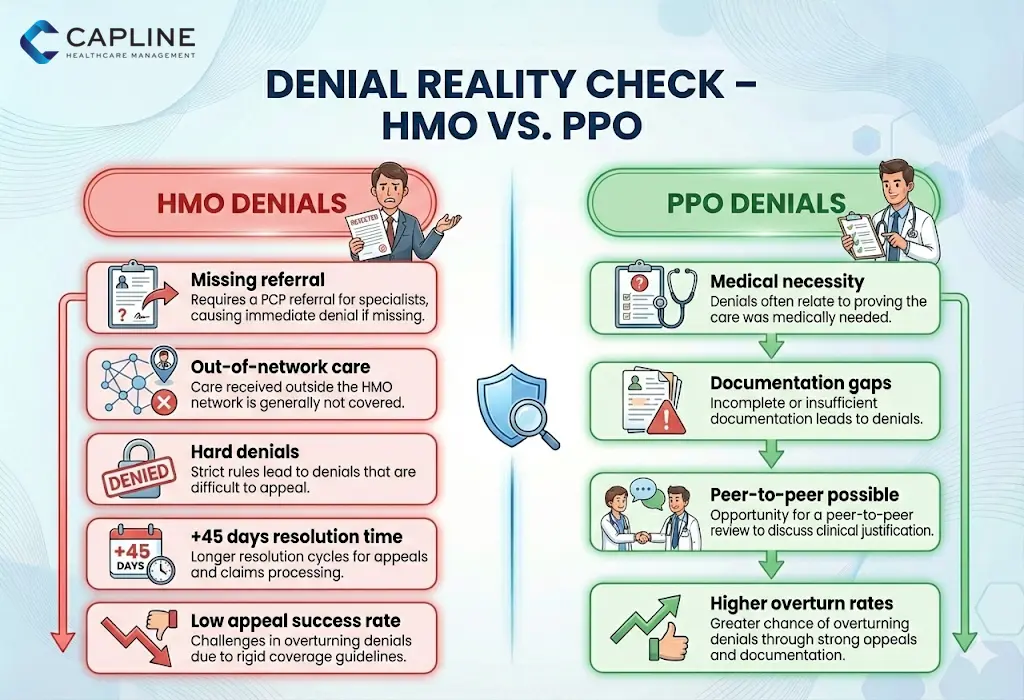

Handling Denials and Appeals: Do doctors prefer HMO or PPO?

This is where the “rubber meets the road” for most medical billing departments. This is one of the reasons as to “why do doctors not like HMO” in most cases; it is only through understanding the nuances of denials.

1. The HMO Denial Loop

In an HMO, a refusal is usually based on a “lack of referral or out-of-network position. These are hard denials, which are extremely hard to retract. When the PCP fails to check the appropriate box, the specialist will not receive payment at all. An MGMA report of 2025 found that practices reported that HMO-based denials took 45 days longer on average to settle than PPO claims.

2. The PPO Challenge

Dismissal of PPO cases is typically connected with the medical necessity. They are frustrating but can be frequently won by a peer-to-peer review or with the submission of more clinical documentation. We realize that we have a better bargain in a PPO appeal since the contract is not as fully held by the “gatekeeper” rule.

3. Common Reasons for Denial in 2025:

- Incorrectly coded telehealth modifiers.

- Missing prior authorization for “high-cost” imaging (even in PPOs).

- Experimental treatment exclusions.

Conclusion

When we look at the question, “Do doctors prefer HMO or PPO?” The answer depends on your specialty and your tolerance for paperwork, but the PPO remains the gold standard for practice autonomy. If you need help, then contact Capline today!

FAQs

1. Do doctors get paid differently for PPO vs. HMO patients?

Yes, typically higher for PPO patients due to fee-for-service structures versus HMO capitation or discounted rates.

2. Why do some specialists avoid HMO networks?

Narrower networks, lower reimbursements, and more prior authorization requirements limit autonomy and earnings.

3. Can doctors participate in both PPO and HMO plans?

Absolutely, many do, contracting with multiple payers to diversify patient bases.

4. How does PPO vs. HMO affect a doctor’s malpractice insurance?

Minimal direct impact; HMOs may offer more oversight, potentially reducing risks, but premiums are based on specialty and claims history.

5. What role do quality metrics play in HMO vs. PPO preferences?

HMOs emphasize metrics for value-based pay, appealing to outcome-focused doctors; PPOs are more volume-driven.

6. Are rural doctors more likely to prefer one over the other?

Often, for flexibility in sparse networks and out-of-network coverage.

7. How has telehealth changed doctors’ views on PPO vs. HMO?

Telehealth eases access in both, but PPOs’ flexibility enhances virtual specialist consults without referrals.

8. What happens when a doctor’s HMO contract ends?

They must renegotiate, switch payers, or notify patients; revenue dips are possible without quick transitions.