What are Non-Covered Services in Medical Billing?

At times, healthcare providers present bills to the insurance companies for the medical services enjoyed by the patient, but not covered by that particular insurance plan.

This could happen due to ignorance regarding the particular non-covered services in medical billing under the patient’s insurance. Thus, it is critical to understand the types of non-covered services in medical billing.

This guide is designed to explain legal definitions, look at real-world examples, and discuss the critical role of the Advance Beneficiary Notice (ABN). So let’s start.

What Does Non-Covered Services Mean in Medical Billing?

Fundamentally, non-covered services in medical billing are medical procedures, tests, or supplies that have been specifically excluded in the benefit package by the insurance plan, be it a private or a government agency, such as Medicare. A non-covered service is a question of policy, whereas a rejected claim will be the result of a mere clerical mistake, such as a misspelled name.

In medical billing, non-covered charges are amounts charged for services that are not covered

under Medicare or any other insurance provider. Exclusions are determined by:

- The nature of the insurance plan and the terms of the patient’s policy

- The nature of the medical service

- Whether it was medically necessary according to the insurer.

A denial sometimes means that the service might have been paid for in the case of some conditions (such as more documentation or previous permission). The non-covered charges in medical billing are, however, usually final; the payer does not pay for such kind of service, end of it. This passes the responsibility of the finances to the patient as long as the legal disclosures have been made in advance.

What are the Common Examples of Non-Covered Services?

The only way to handle your revenue properly is to identify the non-covered services in medical billing in advance, before the patient even sets foot in the door. All payers vary in terms of regulations, but within the scope of the everyday practice, one can find standard so-called red flags that are often the basis of the non-covered services.

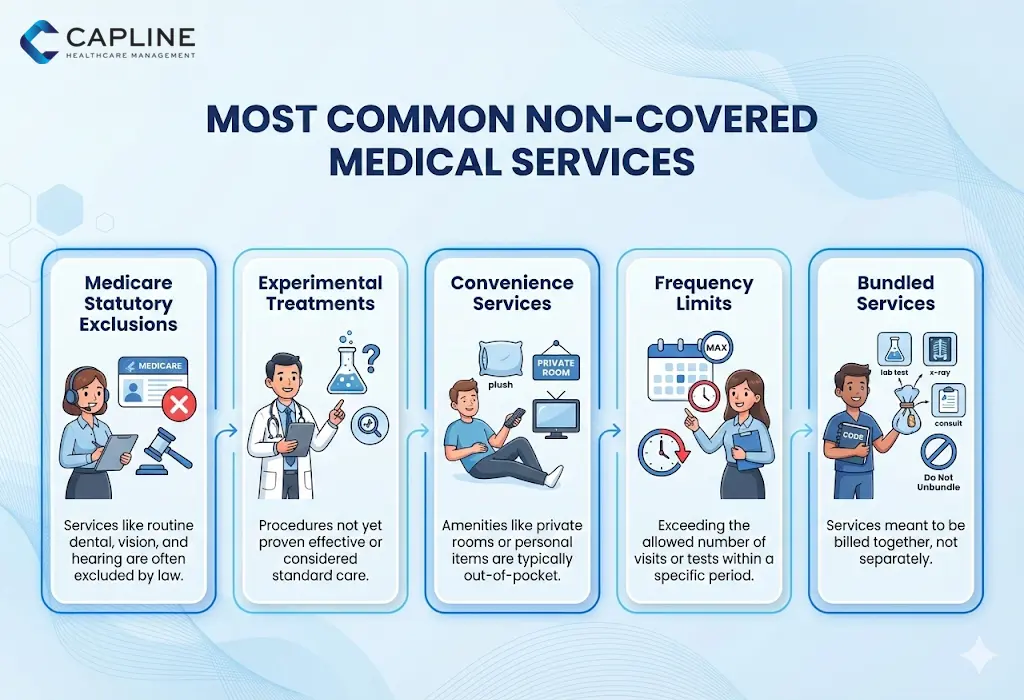

1. Statutorily Excluded Services (Medicare)

Medicare makes it clear regarding its non-payable status. These can be referred to as statutory exclusions.

- Routine Physical Exams: Surprisingly, the annual physical is not available under Original Medicare (however, the annual wellness visit is).

- Cosmetic Surgery: This refers to any operation that is carried out with the sole aim of enhancing beauty and is not functional.

- Hearing Aids and Exams: The majority of routine hearing care is out.

- Dental Care: Routine cleanings, extractions, and dentures usually are not included.

2. Experimental or Investigational Treatments

In case a new drug or surgery procedure is still in the clinical trial or has not been extensively accepted as the standard of care by the FDA or insurance boards, it will usually be considered a denial of non-covered services. This is usually presented to providers attempting to deliver advanced regenerative medicine or off-label application of costly biologics.

3. Convenience or “Luxury” Items

Patient comfort, but not patient clinical needs services, is often non-covered.

- Private Hospital Rooms: These are not frequently covered except in the case of isolation, which is medically required.

- Concierge Services: Boutique practices have monthly membership fees that are never paid with regular insurance coverage.

4. Frequency Limitations

Certain services are reimbursed, however, after every few years. As an example, a screening colonoscopy may be a covered benefit, but when it is done at a higher frequency than the guidelines suggest (e.g., every 10 years in low-risk patients), then the follow-up procedures will be non-covered.

5. Non-Covered Charges Scenario: The “Bundled” Service

There are instances when a service is not covered since it is covered in the payment of another procedure. An example is when you charge for a specialized surgical tool that is included as part of the global surgical fee, then that line item will be reflected as an uncovered charge.

What are Billing and Patient Responsibility?

When a service is found not to be covered, the financial consequence will normally change. But as a provider, you cannot just charge the patient retrospectively without any particular guidelines.

- Financial Liability: In the non-covered services, the patient is normally liable for one hundred percent of the cost.

- The ABN Requirement: In the case of Medicare patients, you are required to give an Advance Beneficiary Notice (ABN) in case you think that a service that would normally be covered by Medicare may be denied due to it being deemed not medically necessary.

- Voluntary Disclosures: With private insurance, the voluntarily disclosed information is not a mandatory legal requirement, as in the case of the ABN. But the signed “Financial Responsibility Form” is a good idea.

- Prior Verification: This should be done before the appointment to find out the non-covered services.

Best Practices for Handling Non-Covered Services in Medical Billing

To avoid revenue leakage, you should follow a streamlined approach:

- Automate Eligibility Checks: Have a program that marks out plan exclusions upon the check-in process.

- Clear Communication: Educate your front-desk employees to conduct the cost conversation with the patients before the service delivery.

- Standardized Coding: Inform the payer with the help of proper modifiers (such as -GA, -GX, -GY, or -GZ) why you are billing the service and whether or not an ABN was signed.

- Frequent Fee Schedule Changes: Make sure that your billing software is updated with the latest payer policies to avoid unexpected non-covered services in medical billing.

- Audit Your Denials: View your non-covered charges denial code data monthly.

Conclusion

Understanding non-covered services in medical billing is not just an administrative task. It’s about protecting the relationship between your practice and your patients.

Would you like our team to perform a comprehensive billing audit for your practice? Contact Capline today to get started.

People Also Ask About Non-Covered Services in Medical Billing

1. What medical services not covered by Medicare can still be billed to patients with an ABN?

Services that otherwise would be included under Medicare but could be refused in a particular case, such as not having medical necessity or frequency of limits, can be charged to patients when an ABN is signed.

2. What’s the difference between a non-covered service and a denial for administrative reasons?

An exclusion is an exclusion on the benefits of the insurance policy (e.g., the plan just does not cover adult orthodontics). An administrative denial is a service that is potentially covered but is denied because of a process error, including the absence of an authorization, a wrong patient ID, or filing after the timely filing limit.

3. What can be the reasons for denial?

The most common causes of denial are the absence of previous authorization, not medically necessary claims, duplicated claims, and the absence of modifiers or false modifiers.

4. Can you bill a patient for a non-covered service?

You may charge a patient for a non-covered service, but you need to inform them in writing prior to the service being offered.

5. What are the common reasons for the classification of a service as non-covered?

The most frequently used reasons are statutory exclusions (services that the law does not pay for), cosmetic purposes, and experimental treatments.

6. How to collect payment for non-covered services?

The best option is to take payment during service delivery. After the patient has signed a waiver or an ABN, your front desk is to give an estimated cost and ask the patient to pay upfront or leave a payment plan in place to make sure that the practice is paid.

7. What denial codes indicate non-covered services on remittance advice?

The most common non-covered charges denial code is PR-96 (Non-covered charge(s)). Other relevant codes include CO-167 (diagnosis is not covered) and CO-204.