What is Offset in Medical Billing? Impact on AR & Denials

If you run a dental treatment brand, even a small “takeback” can mess up your whole week. One day, your claims are paying a fine. The next day, a payer cuts a payment short, and your team is suddenly digging through old EOBs, past claim numbers, and random adjustments.

This happens more often than people think. In Experian’s State of Claims reporting, 41% of respondents said at least 1 in 10 claims gets denied, which adds more rework and delays to your cash flow. On top of that, payers often find overpayments during reviews, and Medicare Fee for Service reported an improper payment rate of 7.66% in FY 2024, which shows how common payment mistakes and corrections can be.

What is an Offset Payment in Medical Billing?

An offset payment, meaning in medical billing, is simple. An offset in medical billing happens when a payer takes back money they believe they overpaid before, by reducing a future payment instead of asking you to send a check.

So instead of paying you the full amount for today’s claim, they subtract the old “overpaid” amount and pay you less. CMS explains this clearly in its Medicare overpayment guidance. A Medicare Administrative Contractor can recover an overpayment by offsetting future payments to satisfy the debt.

To explain it in one line, Offset meaning in medical billing, is the payer’s way of recovering old overpayments by deducting money from new claim payments.

Offset Vs Recoupment

People mix these up a lot.

- Recoupment is the recovery of overpaid money (the process).

- Offset is one method of recoupment (the deduction from future payments).

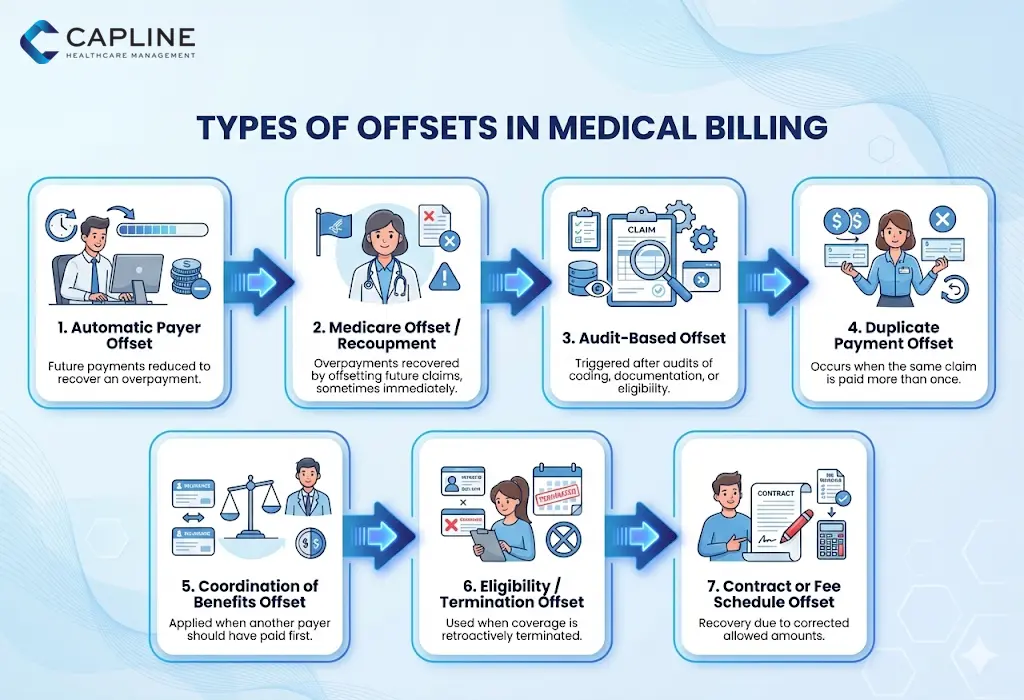

Types of Offset in Medical Billing

Offsets are not all the same. Knowing the type helps you fix it faster and protect your AR.

1) Automatic payer offset

This is the most common one. The payer automatically reduces future payments until the old balance is recovered. This is a standard offset in healthcare behavior when payers detect an overpayment later.

2) Medicare offset and immediate recoupment

Medicare also uses offsets for overpayments. CMS explains that overpayment recovery can happen by offsetting future payments. Some providers request “immediate recoupment,” meaning the payer starts applying the offset right away rather than waiting.

3) Audit based offsets

A payer audit can trigger an offset after they review documentation, coding, or eligibility. These offsets often come with heavy denial risk because the payer may label the earlier claim as invalid.

4) Duplicate payment offsets

This usually happens when:

- The same claim was paid twice

- The claim was resubmitted and paid again

- A secondary payer paid before primary was corrected

5) Coordination of benefits offsets

A Coordination of benefits (COB) change is a big reason for offsets. If the payer finds out later that another plan should have paid first, they may offset the earlier payment.

6) Eligibility or termination offsets

If a patient’s coverage is retroactively terminated, payers often recoup old payments. That becomes an offset on future checks.

7) Contract or fee schedule correction offsets

Sometimes the payer later decides the allowed amount was wrong. They adjust it and recover the difference by offset.

How Offsets Affect the Medical Billing Process

Offsets do not just reduce one payment. They create a chain reaction across AR, denials, and posting.

Offsets hit AR in three major ways:

1) Your cash flow drops suddenly

Even if today’s claims are clean, your deposit is smaller because of an older issue. That can hurt payroll planning, lab bills, and vendor payments, especially for multi location dental brands.

2) Your AR looks “fine” but the money is missing

This is a sneaky problem. If offsets are not posted correctly, your AR report may still show balances as collectible when the payer already took the money back. That is why offsets must be tied to the original claim in your system, not just posted as a random adjustment.

3) Denials go up because the original claim gets questioned

Offsets usually come from an overpayment reason. Overpayments often happen because the payer believes something was wrong on the earlier claim. If that earlier claim was connected to:

- Coding edits

- Missing documentation

- Eligibility issues

- Duplicate claims

Then offsets can lead to more denials in the future, because your claim history gets flagged.

4) Offsets increase posting workload

Offsets also slow down the billing team because your posters must:

- Identify what got offset

- Find the original paid claim

- Match it to the recovery reference

- Fix the balance correctly

Without that, you may chase money that is already taken back.

Procedures Related to Offsetting in Medical Billing

Here is a clean process your billing team can follow to manage offsets properly.

Step 1) Spot the offset quickly

Look for these signs in Electronic Remittance Advice (ERA) and Explanation of Benefits (EOB):

- Lower than expected payment

- Negative adjustment lines

- “Recoupment,” “offset,” “takeback,” or “overpayment recovery” notes

Step 2) Pull the payer details

You need at least:

- Offset amount

- Date applied

- Related claim number or patient reference

- Reason code or explanation

Step 3) Find the original claim in your software

This is the most important step. Do not post the offset only on the current claim. You must link it to the original claim that created the overpayment.

Step 4) Verify the overpayment is real

Before accepting the offset, confirm the old claim was actually overpaid. Make sure to check:

- Allowed amount

- Paid amount

- Patient responsibility

- Coordination of benefits

- Duplicate submission history

Step 5) Post the offset properly

Post the offset as a payer takeback tied to the original claim. Then confirm the current claim’s payment is posted correctly.

Step 6) Decide what action to take

You have three common options:

- Accept the offset and close the balance

- Dispute it if it is wrong

- Appeal if you have proof the original payment was correct

Step 7) Track offsets like a mini project

Create a small offset log with:

- Payer name

- Offset amount

- Original claim date

- Current claim date

- Status (open, appealed, resolved)

- Outcome

This is how you prevent the same payer from offsetting repeatedly without anyone noticing.

Step 8) Watch for interest risk

Some payers apply rules where balances can collect interest if not resolved. For Medicare, overpayments can be offset against current paid claims, and if there is not enough payment to satisfy the full overpayment, the remaining balance could accrue interest until paid.

Common Challenges in Offset Handling in Medical Billing

Offsets sound simple, but in real life they create messy problems.

1) No clear reference to the original claim

Some ERAs show an offset but do not clearly show which claim it belongs to. That forces manual research.

2) Multiple offsets in one payment

A single check can include several offsets across different patients and dates. Without a tracking sheet, posting becomes guesswork.

3) Offsets applied to the “wrong” claim in your system

If the offset is posted to the current claim instead of the original claim, your AR becomes inaccurate and follow ups get wasted.

4) Duplicate adjustments from payer errors

Sometimes a payer offsets twice by mistake. Your team must catch it early or you will lose money.

5) Offsets cause patient balance confusion

If the payer takes back money from a claim that already had patient billing, you may need to rebill or adjust the patient portion.

This matters a lot in dental, where patients often pay upfront, and later insurance changes can trigger offsets.

6) Appeals take time and slow AR

Even when the offset is wrong, the appeal process can drag. Meanwhile, the payer keeps reducing payments.

7) Offsets hide inside “small short pays”

Not every offset looks like a big takeback. Some show up as tiny reductions that are easy to ignore. Over time, those add up.

Conclusion

Offset in medical billing is one of those issues that looks small on paper but hits hard in real cash flow. It can reduce payments without warning, raise denial cleanup work, and mess up your AR reports if it is not posted correctly.

The best way to handle offsets is to treat them like a trackable event, not just a random adjustment. When you catch them early, tie them to the correct claim, and verify the reason, you protect revenue and keep your billing team sane.

Need help managing offset tracking, posting, and appeals without burning your team out?

Capline Healthcare Management can support your AR and denial workflow so offsets do not quietly eat your collections. Connect with us today.

People Also Ask About Offset in EOB

1. What is an offset in EOB?

An offset in an EOB means the payer reduced your current payment to recover money they believe was overpaid earlier. It may appear as a negative adjustment, a recoupment line, or a takeback note.

2. What is an offset in a claim?

An offset in a claim is when the payer subtracts an old overpayment amount from the payment they owe on a new claim. The new claim can be perfectly correct, but the payment is reduced anyway.

3. What are the impacts of offsetting on financial health?

Offsets can hurt financial health by lowering cash flow, increasing AR days, adding more posting work, and triggering denials if the original claim issue is not fixed. Medicare also notes that overpayments can be recovered by offsetting future payments, which can directly reduce ongoing revenue.

4. What is the difference between recoupment, refunds, and offset?

Recoupment is the overall recovery process. Refund is when the provider sends money back. Offset is when the payer recovers money by reducing future claim payments.

5. What are the common reasons for overpayment?

Common reasons include duplicate payments, incorrect codes, coordination of benefits changes, retro eligibility termination, and payer audit findings. Offsets are a common method payers use to recover these overpayments.