What is Assignment of Benefits (AOB) in Medical Billing

Is the administrative burden of pursuing patients to have insurance checks they already cashed choking your cash flow? To most doctors and practice managers in the US, “the check is in the mail” is a nightmare, which interferes with Revenue Cycle Management (RCM).

This is where understanding the legal and operational nuances of an Assignment of Benefits (AOB) becomes critical. This guide is a breakdown of the exact way AOB in medical billing works, why it is the foundation of a stable practice revenue, and the legal pitfalls you have to overcome to remain compliant.

Regardless of whether you are an out-of-network specialist or a high-volume primary care clinic, the mastery of this document is the beginning of securing your bottom line. So let’s start.

What is Assignment of Benefits?

In the easiest language, AOB has the name in medical billing as “Assignment of Benefits.” It is a legal arrangement documented via a signed form whereby a patient requests that their insurance company pay their health benefits directly to the healthcare provider rather than to the patient themselves.

In the absence of a valid AOB, it is usually a legal duty of an insurance carrier to send a policyholder (the patient) the reimbursement check. This compels your billing department to charge the patient the entire amount, hoping they did not use the insurance money, and wait until they receive a personal check. Through AOB in healthcare, you eliminate the middleman (the patient) in the reimbursement part of the claim, which enables your practice to be paid by the payer.

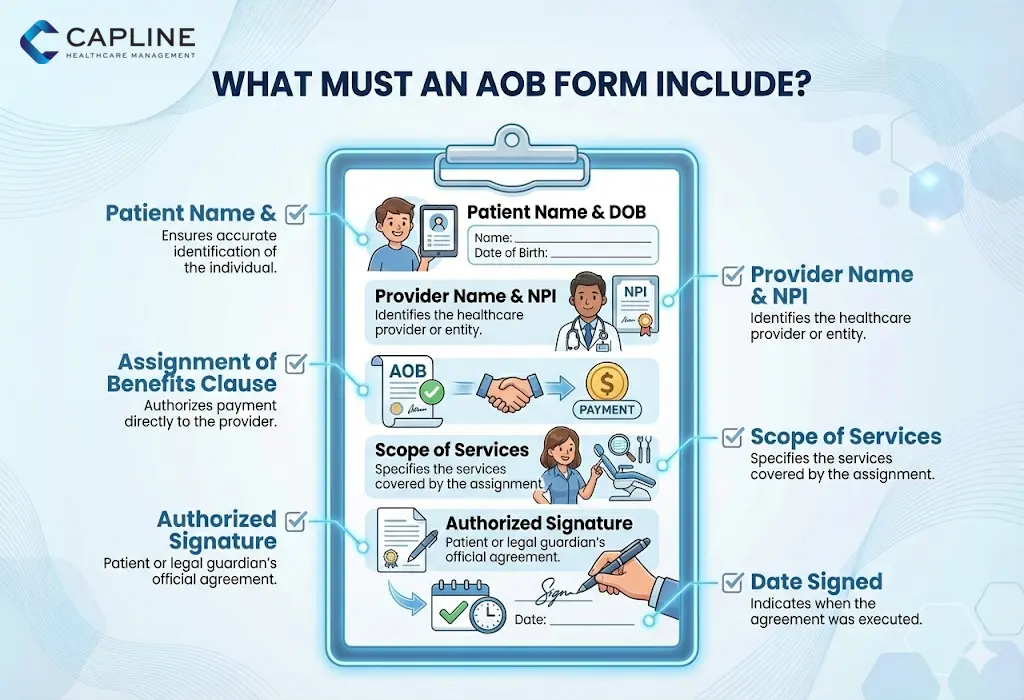

What is an AOB form, and What Must It Include?

An AOB form is more than just a signature on a piece of paper; it is a binding legal contract.

An effective AOB form must include:

- Patient Identification: Full name, date of birth, and policy ID number.

- Provider Information: legal name of the practice and NPI (National Provider Identifier).

- The “Assignment” Language: Simple language stating that the patient is delegating his right to be given benefits to the provider.

- Scope of Services: This is whether the assignment concerns a particular date of service or all future services.

- Authorized Signature: Signature of the policyholder or any legally authorized representative.

- Date of Performance: A time indication so as to demonstrate that the agreement existed prior to the processing of the claim.

How Does AOB Work in Medical Billing?

In order to get the most out of your RCM, you need to realize the lifecycle of a claim that has an assignment agreement. AOB in medical billing is not a front desk job, but more like a change in the direction of money flowing in your office.

1. The Point of Service (POS) Collection

Upon a patient’s admission, your front desk informs you whether the practice is in-network or out-of-network. When you are out of network, the only thing that is certain is the signed AOB, that the insurance company will not put a $5,000 surgery reimbursement check in the home address of the patient.

2. Claim Submission with “Box 27”

When your billers submit the CMS-1500 form, they must look at Box 27 (Accept Assignment). The provider confirms to take the insurance-permitted amount as full payment (conventional in-network) by checking “Yes.” However, it is the very AOB form that legally permits the carrier to route that payment to your bank account.

3. Direct Reimbursement and EOB Generation

The claim goes through the payer. Since a valid AOB exists on file (and in most cases, this is indicated by a “Signature on File” notation in Box 12 and 13), the payer makes a direct deposit or virtual credit card payment to the provider. An Explanation of Benefits (EOB), in which the patient is informed of what has been paid, is sent to them, but the money ends up in the account of your practice.

4. Patient Responsibility Residuals

The patient is also liable to copays, coinsurance, and deductibles, even with an AOB. The AOB merely diverts the insurance component of payment.

Key Benefits of Assignment of Benefits in Medical Billing

- Accelerated Cash Flow: You get payments through ERA/EFT and usually 2-3 weeks sooner than you would otherwise wait until a patient sends you a check.

- Reduced Collection Costs: You need not forward a variety of statements or even employ collection agencies to recover insurance money that the patient accidentally (or intentionally) used.

- Legal Standing to Appeals: A signed AOB usually provides the provider with the so-called standing to appeal or sue an insurance company that underpaid.

- Administrative Efficiency: Your billing department does not spend as much time on the phone clarifying EOBs to patients who are not clear.

Legal Implications and State Regulations

Now comes “What is the assignment of benefits in medical billing?” AOBs are not considered to be legal everywhere in the United States.

Anti-Assignment Clauses

Several massive payers (such as Blue Cross Blue Shield in some states) incorporate “anti-assignment clauses” into their member contracts. These provisions clearly forbid the assignment of benefits to out-of-network services by patients. The courts supported these clauses in some cases and have found them contrary to public policy in other cases.

State-Specific Bans and Rules

Massive legislative changes have occurred in Florida. As an example, Florida enacted major changes in 2023-2024 to discourage AOB abuse in property insurance, which has also impacted the environment for healthcare AOBs as well.

- Texas: AOBs are generally permissible in the state, but the provider must notify the payer in a very specific manner.

- California: Protections are strong on the provider side, though now, due to surprise billing laws (such as the No Surprises Act), the use of AOBs in an emergency situation is overridden.

The Federal Oversight (ERISA)

In case you have employer-sponsored health plans, the claim is often regulated by ERISA (Employee Retirement Income Security Act). A well-written AOB is key to the practice being able to enter into the “shoes” of the patient in order to bring a claim against the violator of the federal or state law to your benefit.

Common Challenges and Solutions

| Challenge | Practical Solution |

| Patient Revokes AOB | Include a “non-revocable” clause or require 30 days written notice for revocation. |

| Payer Ignores AOB | Send a formal “Letter of Intent to Appeal” accompanied by the signed AOB. |

| Expired Forms | Update your AOB forms annually during the patient’s first visit of the year. |

Who Should Use AOB?

Although most practices are required to involve a variation of an AOB, it is essential to:

- Out-of-Network (OON) Providers: This is the key to zero leverage with the insurance company.

- Experts: Due to the expensive nature of the procedures, the chance of non-payment by patients is too high to be neglected.

- DME (Durable Medical Equipment) Suppliers: Equipment is commonly provided without being paid in advance, and this means that the AOB secures the cost of the asset.

Conclusion

Knowing AOB in medical billing is not merely a clerical requirement but a crucial protection of the financial well-being of your practice. By making each and every patient sign an unambiguous, legally binding assignment form, you bind the chances of lost revenue and administrative nightmares to a small fraction, allowing you to concentrate on patient care. We at Capline are experts in sealing such RCM loopholes to allow you to focus on the patient. Contact us today!

People Also Ask

1. Where does the patient usually authorize the assignment of benefits?

The authorization is typically found within the initial intake paperwork. It is often a standalone form or a clearly marked section in the financial policy agreement that requires a separate signature and date.

2. When should providers request an AOB from patients?

We recommend requesting a signed AOB during the first visit of every calendar year. This ensures that any changes in the patient’s insurance policy or legal status are captured before a claim is filed.

3. How does AOB affect patient responsibility for deductibles?

It does not change the amount the patient owes. The AOB only impacts the insurance reimbursement. The patient is still legally responsible for any deductibles, copays, or coinsurance as outlined by their plan.

4. What happens if a patient revokes assignment of benefits?

If a patient revokes the AOB, the insurance company will resume sending payments directly to the patient. You must then treat the account as a “self-pay” or “unassigned” claim, which may require collecting the full estimated amount upfront.

5. Which states have specific AOB regulations or bans?

Florida, Texas, and Georgia have specific statutes regarding the “standing” of a provider to sue based on an AOB. Additionally, some states prohibit AOBs for specific types of government-funded plans.

6. How does AOB differ from direct billing without assignment?

Direct billing without assignment means you are sending a courtesy claim for the patient, but the insurance company sees the patient as the payee. With an AOB, the insurance company recognizes the provider as the legal “assignee” of the funds.

7. What mistakes void an AOB agreement?

Common mistakes include missing signatures, using a “stale” form (dated years ago), or failing to include the specific name of the healthcare entity that provided the treatment.

8. What documentation proves a valid AOB for claim appeals?

To win an appeal, you need a clear, legible copy of the signed AOB form, a copy of the patient’s insurance card, and proof that the form was submitted to the carrier along with the original claim.